July

31

July

31

Japanese Economy Under Siege

The Bank of Japan went into the 2nd quarter of this year with a rather bullish outlook on the economy and price inflation. The April 1st sales tax hike from 5% to 8% has taken effect and it is now becoming clear that the Abe administration underestimated the impact. In the last few months, inflation has stalled, the trade deficit has expanded and business sentiment has deteriorated. It was forecasted that economic activity would be front loaded to the Q1 2014 period before the April sales tax hike and there would be a decline afterwards . This seems to have been the case as the recent slowdown has been quite sudden occurring in tandem with the sales tax hike and a dive in Prime Minster Shinzo Abe’s approval ratings.

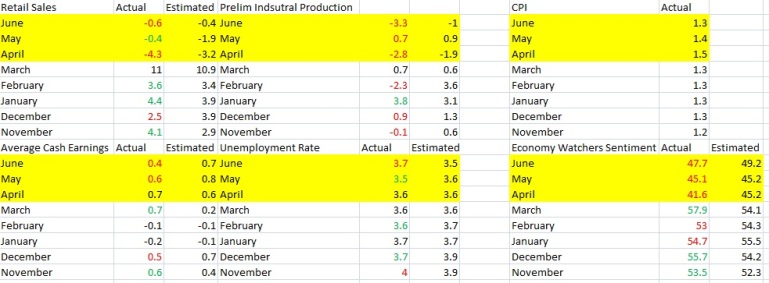

The greatest concern to Bank of Japan boss Haruhiko Kuroda must be the slowing increase in inflationary pressures and stalling wage growth. Real wages are down 3.8% year over year, the largest decline since 2009. The sales tax hike in tandem with significantly weaker Yen has hampered consumer purchasing power as retail sales came in far below expectations last month. While the BoJ forecasted a summer time slowdown in inflation, they did not see what has become an apparent wider crunch in economic activity. Industrial production data out on July 29th saw a 3.3% decline vs a -1% estimate with the Ministry of Economy,Trade and Industry saying that industrial production has ‘weakened’, production and shipments ‘decreased’ and most notably inventories ‘increased for the second straight month’.

Yellow Areas are Post Sales Tax Hike

The implications for currency markets are significant given that throughout Q2 market sentiment was bullish on Japan and seemed to be shifting away from the idea that the BoJ would expand its asset purchase program in October. It was thought that the Japanese economy, at least in the pre tax hike period was recovering well and there was no additional stimulus needed. At the current moment October may be too soon for the BoJ to add to its easing policies, but at the very least their current program of buying 60tn-70tn Yen per year of government bonds will need to continue for a very long time to reach their 2% inflation target.

The BoJ is becoming vulnerable to being stuck in QE mode for years as another sales tax hike from 8% to 10% is likely to occur in October 2015 if Abe approves the move. Another period of significant Yen weakness may be imminent as the Federal Reserve and Bank of England move towards normalizing policy while the European Central Bank could soon be successful in stoking a mild increase in inflation. If interest rates across developed markets begin to rise while the Bank of Japan is forced to continue or add to ultra easy policies, expect huge outflows from Japanese life insurers and pension funds to seek higher rates overseas.

Recent Comments